Let’s Be Honest: The Economy Is NOT Doing Well

The American economy is not all right. But to see why, you need to look beyond the dramatic numbers we keep seeing in the headlines and establishment talking points.

Take, for instance, the latest jobs report. For the third month in a row, the American economy added significantly more jobs than most economists had been expecting—a total of 303,000 for March. On its face, that’s a good number.

But as Ryan McMaken laid out over the weekend, things don’t look as strong when you dig into the data. For instance, virtually all the jobs added are part-time jobs. Full-time jobs have actually been disappearing since December of last year. In fact, as McMaken highlighted, “The year-over-year measure of full-time jobs has fallen into recession territory.”

Also, most of these new part-time jobs are going to immigrants, many of whom are in the country illegally. There has been zero job creation for native-born Americans since mid-2018. While immigrants are not harming the economy by working, the scale of new foreign-born workers has papered over the employment struggles of the native-born population.

Further, government jobs accounted for almost a quarter of those added—way above the standard ten to twelve percent. Just like with government spending and economic growth, government hiring boosts the official jobs number while draining the actual, value-producing economy.

Some economists, like Daniel Lacalle, argue that the US economy is already experiencing a private-sector recession but that government spending and hiring are propping up the official data enough to hide it.

A recession is inevitable, thanks to the last decade of interest rate manipulation by the Federal Reserve—and especially to its dramatic actions during the pandemic. The recession-like conditions in full-time jobs is further evidence that Lacalle is right.

But jobs numbers are only part of the story. The stock market has been fluctuating a lot recently, not because of changing consumer needs or the adoption of some new technology, but based on what Federal Reserve officials are saying about what the central bank will do this year.

At the same time, prices are still high. And they continue to rise at a rate that frustrates even some of President Joe Biden’s biggest economic cheerleaders. Our dollars are worth about 20 percent less than they were four years ago, with no prospect of that trend reversing. That hurts.

But instead of addressing this economic pain, much less their role in creating it, members of the political class are still pretending everything is great. They’re even gearing up to make things worse by, for example, sending even more of our money to the Ukrainian government. All to prolong a war it’s losing, not because of a lack of money, but because of a lack of soldiers.

And at home, President Biden is scrambling to put the brakes on energy production and to transfer money from the working class to his base of college graduates, all before he’s up for reelection in November.

Predictably and appropriately, the establishment’s head-in-the-sand economic strategy is coinciding with a notable decrease in support for the Democrats—the establishment’s preferred party these days. President Biden is behind in the polls in six of the seven swing states and is losing support from working-class and nonwhite voters.

The political establishment and its preferred candidates deserve to lose support, not only for failing to acknowledge America’s economic problems but for causing them in the first place.

Learn Why The Globalists Are Killing Their Own Monetary System

CDC Quietly Admits to Covid Policy Failures

In so many words—and data—CDC has quietly admitted that all of the indignities of the Covid-19 pandemic management have failed: the masks, the distancing, the lockdowns, the closures, and especially the vaccines; all of it failed to control the pandemic.

It’s not like we didn’t know that all this was going to fail, because we said so as events unfolded early on in 2020, that the public health management of this respiratory virus was almost completely opposite to principles that had been well established through the influenza period, in 2006. The spread of a new virus with replication factor R0 of about 3, with more than one million cases across the country by April 2020, with no potentially virus-sterilizing vaccine in sight for at least several months, almost certainly made this infection eventually endemic and universal.

Covid-19 starts as an annoying, intense, uncomfortable flu-like illness, and for most people, ends uneventfully 2-3 weeks later. Thus, management of the Covid-19 pandemic should not have relied upon counts of cases or infections, but on numbers of deaths, numbers of people hospitalized or with serious long-term outcomes of the infection, and of serious health, economic, and psychological damages caused by the actions and policies made in response to the pandemic, in that order of decreasing priorities.

Even though numbers of Covid cases correlate with these severe manifestations, that is not a justification for case numbers to be used as the actionable measure, because Covid-19 infection mortality is estimated to range below 0.1% in the mean across all ages, and post-infection immunity provides a public good in protecting people from severe reinfection outcomes for the great majority who do not get serious “long-Covid” on first infection.

Nevertheless, once the Covid-19 vaccines were rolled out, with a new large wave of the Delta strain spreading across the US in July-August 2021 even after eight months of the vaccines taken by half of Americans, instead of admitting policy error that the Covid vaccines do not much control virus spread, our public health administration doubled down, attempting then to compel vaccination on as many more people as could be threatened by mandates. That didn’t work out too well as seen when the large Omicron wave hit the country during December 2021-January 2022 in spite of some 10% more of the population getting vaccinated from September through December of 2021.

A typical mandate example: in September 2021, Washington Governor Jay Inslee issued Emergency Proclamation 21-14.2, requiring Covid-19 vaccination for various groups of state workers. In the proclamation, the stated goal was, “WHEREAS, COVID-19 vaccines are effective in reducing infection and serious disease, and widespread vaccination is the primary means we have as a state to protect everyone…from COVID-19 infections.” That is, the stated goal was to reduce the number of infections.

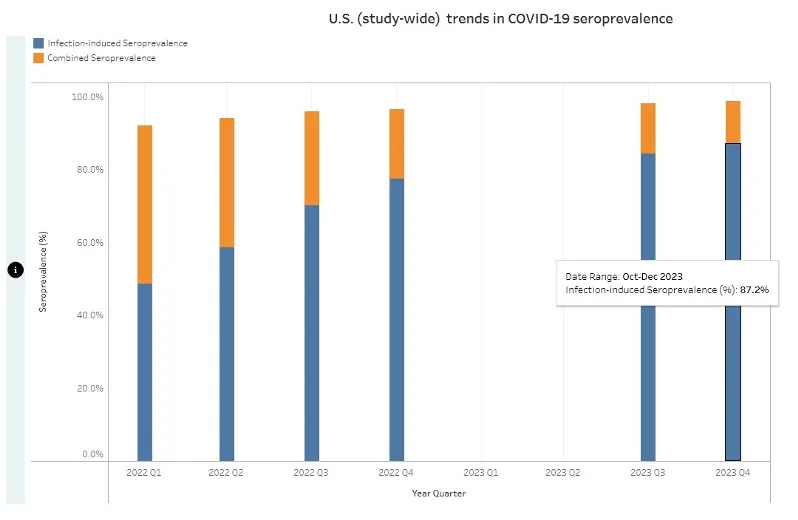

What the CDC recently reported (see chart below), however, is that by the end of 2023, cumulatively, at least 87% of Americans had anti-nucleocapsid antibodies to and thus had been infected with SARS-CoV-2, this in spite of the mammoth, protracted and booster-repeated vaccination campaign that led to about 90% of Americans taking the shots. My argument is that by making policies based on number of infections a higher priority than ones based on the more serious but less common consequences of both infections and policy damages, the proclaimed goal of the vaccine mandate to reduce spread failed in that 87% of Americans eventually became infected anyway.

In reality, neither vaccine immunity nor post-infection immunity were ever able fully to control the spread of the infection. On August 11, 2022, the CDC stated, “Receipt of a primary series alone, in the absence of being up to date with vaccination* through receipt of all recommended booster doses, provides minimal protection against infection and transmission (3,6). Being up to date with vaccination provides a transient period of increased protection against infection and transmission after the most recent dose, although protection can wane over time.” Public health pandemic measures that “wane over time” are very unlikely to be useful for control of infection spread, at least without very frequent and impractical revaccinations every few months.

Nevertheless, infection spread per se is not of consequence, because count of infections is not and should not have been the main priority of public health pandemic management. Rather, the consequences of the spread and the negative consequences of the policies invoked should have been the priorities. Our public health agencies chose to prioritize a failed policy of reducing the spread rather than reducing the mortality or the lockdown and school and business closure harms, which led to unnecessary and avoidable damage to millions of lives. We deserved better from our public health institutions.

Alex Jones Responds To Revelation That FBI/CIA Attempted To Silence Him And Shut Down Infowars

Central Banks Are Buying the Gold Top

In investing, “Buy low, sell high” is among the most well-known sayings, and generally, it’s good advice. But with gold still holding near its historic all-time highs, central banks led by China are bucking the classic adage and smash-buying more, buying the top to fortify themselves against a global monetary and financial blow-up.

Last month marked the 17th in a row that the People’s Bank of China (PBOC) continued stacking gold. Notably, the bank typically reports lower numbers than its actual buying volume and is now also introducing a digital yuan to facilitate cross-border gold settlements.

The People’s Bank of China announced its gold reserve data for March, with an additional 160,000 ounces of gold reserves added, bringing the total reserves to 72.74 million ounces. pic.twitter.com/Ngalymi8nd

— Bai, Xiaojun (@oriental_ghost) April 8, 2024

Russia is also doubling its reserves of gold and foreign currencies on its de-dollarization path, further detaching Russia from the petrodollar empire as it reacts to wartime sanctions from the US and EU. There are other blips on the de-dollarization map as well: though much smaller than Russia and China, Zimbabwe has a new gold-backed currency that lets them dump the USD for trade with China and other countries.

Chinese citizens are trying to divest as well, but from their economy — Chinese buying has become so blistering that gold ETFs have gone haywire, with China repeatedly halting trading as ETFs rocket upward at a gobsmackingly-high premium against physical bullion. It has become increasingly difficult for the Chinese to invest outside of China, due to attempts by the regime to keep investments within the country. Citizens are trying to make moves to protect themselves against their perceptions of domestic economic uncertainty.

Meanwhile, expectations that the Fed and other Western central banks will be cutting rates this year amidst continuing wars in Ukraine and the Middle East provide further rocket fuel for the gold price, with central bank buying helping it hold its new levels despite whatever else seems to be going on in global markets.

A Year of Central Bank Buying: Gold vs USD April 2023 – April 2024

While shorter-term corrections are always to be expected, the macro factors support the view that, despite its awe-inspiring path upward in the past few months, the rally for gold hasn’t finished. While inflation isn’t contained, the Fed is expected to stay the course with planned 2024 rate cuts that will make dollar weakness even worse. This can only mean higher prices for gold against USD.

Reacting to warnings from Bloomerberg about ballooning debt and the powder keg of inflationary pressure, Peter Schiff said:

“We have a much bigger problem than they acknowledge — that’s why the price of gold is at a record high, that’s why it’s going to keep going up.”

With the overstretched and over-indebted American empire increasingly in a state of potentially terminal decline, BRICS countries are stacking hard assets with the hopes of overtaking the West as the next economic superpowers in the coming decades. While they have fiat currencies of their own, none have anything resembling the world reserve currency status enjoyed by the USD. Buying the top even as gold continues upward tells a story of their future visions of US dollar chaos.

Besides, if you expect the dollar to fail, as dominant fiat currencies historically have, then “the top” doesn’t matter — if the bottom for fiat is zero, then there’s no meaningful top for hard assets like gold in fiat terms. And just as you didn’t want to be the last schmo holding seashells when no sane person would give you even the tiniest sliver of gold in exchange, it’s wise of central banks to avoid being the last ones trying to trade worthless paper for gold that, when fiat is functionally dead, will be infinitely more valuable.

Because when you zoom out far enough, the exchange price of fiat currencies always reverts to its true value of zero.

Learn Why The Globalists Are Killing Their Own Monetary System

UK Gov’t Data Reveals 16X More Deaths In Vaccinated Cohort As ‘Tsunami of Death’ Sweeps Nation

Official British government data from the Office of National Statistics (ONS) comparing “Deaths by Vaccination Status” reveals that people vaccinated against Covid-19 with mRNA vaccines are dying far more often than those who are unvaccinated. […]

The post UK Gov’t Data Reveals 16X More Deaths In Vaccinated Cohort As ‘Tsunami of Death’ Sweeps Nation appeared first on The People’s Voice.