Fed Chair Jerome Powell Criminally Referred For Alleged Perjury

CBS Cancels Colbert: Trump Dances on Grave, Kimmel Triggered, Dems Asks If Political

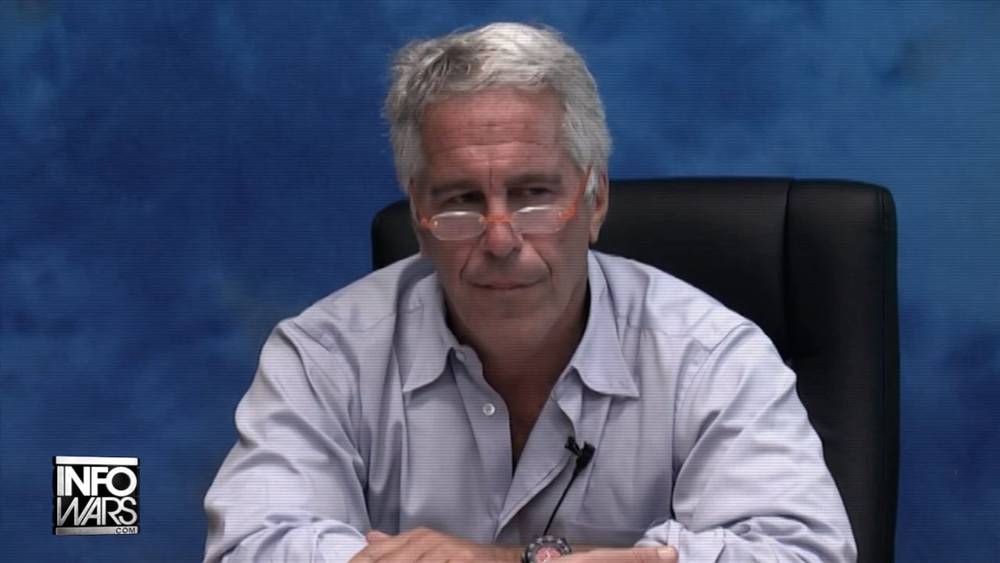

EXCLUSIVE: “I Feel Very Strongly That Jeffrey Epstein Was A Mossad Access Agent”

517 People Were Euthanized Against Their Will in The Netherlands in 2021

FULL INTERVIEW: Former CIA Counterterrorism Chief Warns That Israel Is Attempting A Stealth Coup Takeover Of The New Trump Administration

‘An Encouraging Sign’: 60% of Pregnant Women and Young Mothers May Delay or Refuse Routine Vaccines for Kids