MUST WATCH: Funeral Home Director John O’Looney Exposes The Secret COVID Holocaust

UK funeral home director John O’Looney joins Alex Jones to discuss the strange blood clots he’s discovered in cadavers ever since the COVID vaccine rollout.

Hollywood Elite Panic As P Diddy Victim Vows To Name VIP Pedophiles

Recent sex abuse lawsuits against Sean “Diddy” Combs have damaged the reputation and career of one of the music industry’s most successful and wealthy men. But a new suit from music producer Rodney “Lil Rod” […]

The post Hollywood Elite Panic As P Diddy Victim Vows To Name VIP Pedophiles appeared first on The People’s Voice.

Special Report: The US Is In A Crisis Of Tyranny

Here are just a few of the hundreds of tragic stories that reflect the brutality of tyrannical overreach by criminals occupying the highest offices of our government, which the Founders warned us about with prophetic vision.

Federal Agents Arrest Journalist For Reporting on Jan 6 and Exposing Government Role

FBI agents have arrested journalist Steve Baker for covering the January 6 protests and daring to challenge the official narrative surrounding the event. The Blaze journalist was arrested on Friday morning by FBI agents and […]

The post Federal Agents Arrest Journalist For Reporting on Jan 6 and Exposing Government Role appeared first on The People’s Voice.

Democrat Senator Says Pedophiles Deserve ‘Child Sex Dolls’ To ‘Give Them a Release’

Pedophiles must be given “child sex dolls” to “give them a release”, according to Kentucky Democrat Senator Karen Berg who also stated that child rapists should be referred to as “minor attracted persons” or “MAPS” […]

The post Democrat Senator Says Pedophiles Deserve ‘Child Sex Dolls’ To ‘Give Them a Release’ appeared first on The People’s Voice.

Slower US Mint Sales Are Keeping Coin Premiums Low

Even as central banks buy more gold than ever, coin premiums have been driven lower throughout the retail precious metals market. One of the big factors: is disappointing sales from the US Mint.

In addition to keeping sales profitable, the markup on physical gold and silver coins helps cover costs like administration, storage, and transportation. The US Mint is a bureau of the US Department of the Treasury, and in addition to handling gold movements to central banks and fulfilling other duties, it’s a major producer and seller of physical bullion. Its customers are a handful of authorized gold and silver dealers, who then sell the products to retail investors.

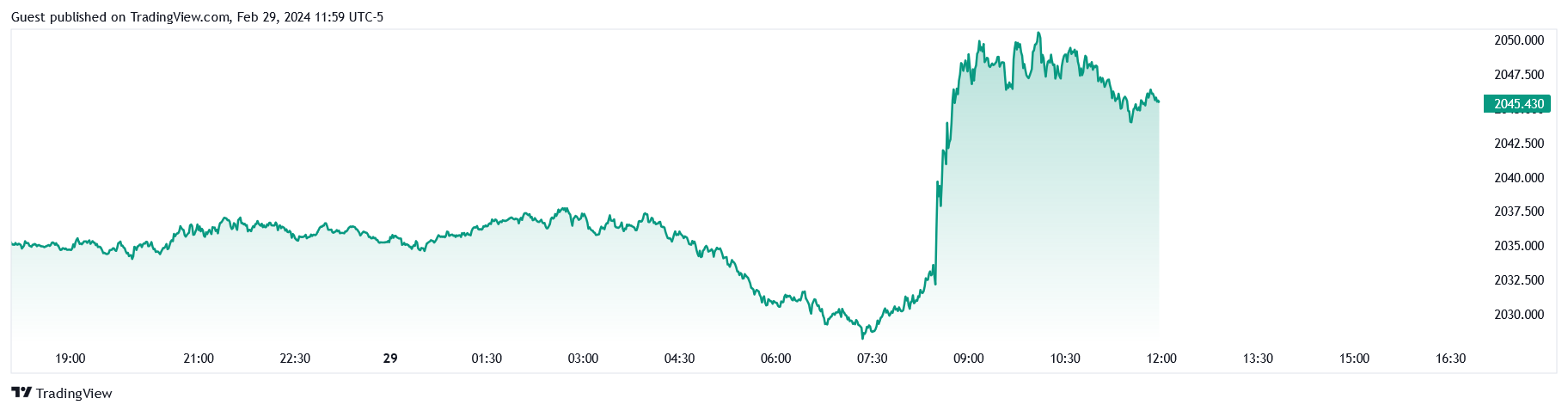

The US Mint’s market share is significant enough that when sales there are low (or high) enough, it affects the mark-up rates across the wider bullion market. That’s what we’re seeing now, even as gold shows healthy price action and looks poised to go even higher in the face of global war and weak fiat currencies:

Gold vs USD, 5-Day Chart

Overall in the 2023 fiscal year, revenue at the US Mint dropped almost 13% despite sales volume increasing 24.5% compared to 2022. The sales increase was driven by the popularity of American Silver Eagles, which wasn’t enough to offset the sharp decline in sales for other bullion products. As CoinNews’s Mike Unser reports:

“Demand for U.S. Mint gold bullion coins saw a significant decline compared to the prior year, with sales of American Gold Eagles dropping by 20.7% to 988,000 ounces and sales of American Gold Buffalos decreasing by 19.2% to 375,000 ounces.”

These are some of the most popular gold coins for bullion investors to stack. With lower sales of these mainstay coins, the US Mint saw a significant subsequent drop in income.

“Consequently, revenue for American Gold Eagles decreased by 17% to $1.9651 billion, while revenue for American Gold Buffalo coins fell by 15.3% to $738.1 million.”

The past two weeks alone have seen major sales declines compared to the US Mint’s average. According to CoinNews.net’s sales data from the US Mint, silver and gold numismatics took one of the biggest hits from losses. For example, 2024 Commemorative Coins saw a 10% drop in sales of the 2024-S Proof Harriet Tubman Half Dollar, which was one of the most significant declines.

Meanwhile, in Asia, premiums are mixed. They’ve notched up higher in China as the Lunar New Year comes to a close, and bullion sales can resume. But in India, it’s the end of the famously gold-soaked wedding season, which always leads to a relative drop in retail demand since gold is a major cultural component in Indian nuptials. With less demand because of this, premiums in India are down compared to previous weeks.

If the downward sales trend continues at the US Mint, it makes for an even better time to buy gold. Bullish momentum combined with lower premiums gives you more bang for your fiat buck. But if the Mint sees a resurgence, the price of gold could go higher — and this time, spot premiums might go up with it.

BREAKING: Dan Bongino Breaks Spy Story Of The Century, Alex Jones Sends Emergency Message