EXCLUSIVE: MTG Warns The Democrats Are Trying It Again, “We Know What Their Play Is— They Want To Steal The Election With People Who Are Not Citizens Voting”

Pennsylvania County District Attorney Announces Bust of Large-Scale Voter Fraud Scheme Registering Thousands of Fake Voters

BREAKING EXCLUSIVE: Federal Judge BLOCKS Democrat Party’s Attempt To Claim Ownership Of Alex Jones’ Name

Auschwitz Survivor Goes Thermonuclear on Kamala For Comparing Trump to Hitler

A Holocaust survivor ripped Democrat presidential candidate Kamala Harris for describing former President Donald Trump as a fascist and comparing him to Hitler. A video released by the Trump campaign features Jerry Wartski, 94, as […]

The post Auschwitz Survivor Goes Thermonuclear on Kamala For Comparing Trump to Hitler appeared first on The People’s Voice.

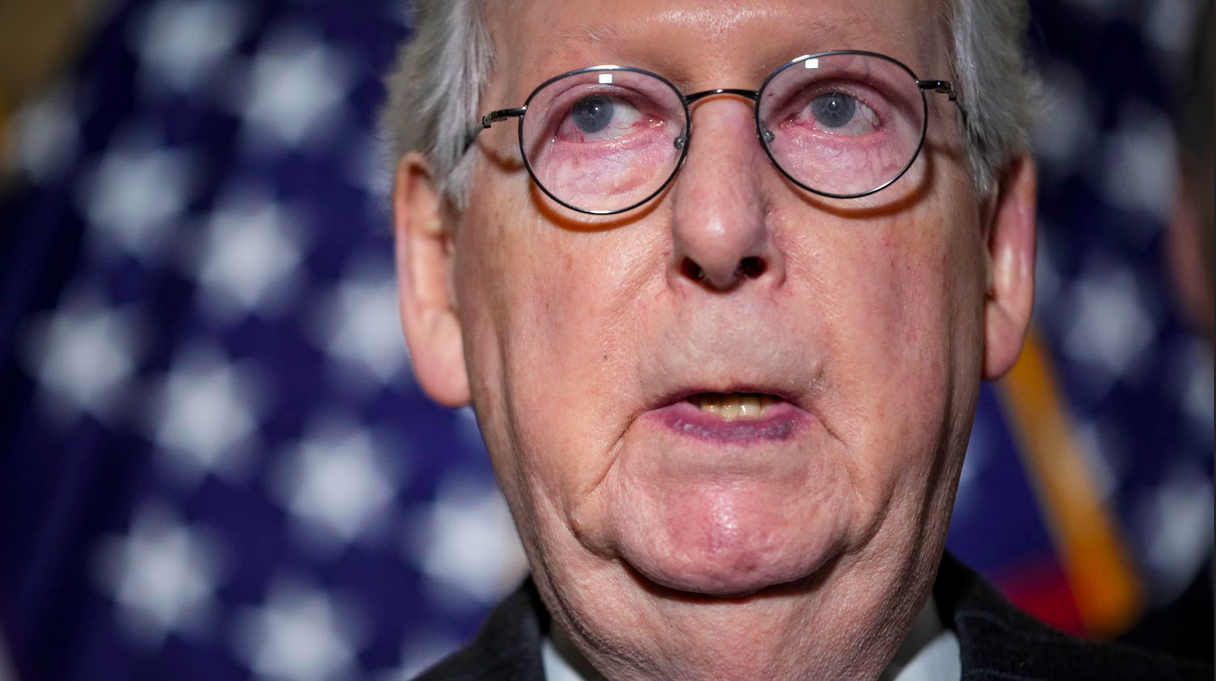

Mitch McConnell Claims Trump Supporters Are ‘Losers’ Seeking Excuses for Their Own Failures

RINO Mitch McConnell has attacked Republican presidential nominee Donald Trump and his supporters just two weeks before the election, calling Trump a “sleazebag” and “narcissist” and describing his supporters as “losers” who are looking for […]

The post Mitch McConnell Claims Trump Supporters Are ‘Losers’ Seeking Excuses for Their Own Failures appeared first on The People’s Voice.