Should Germany’s AfD Voters be Refused Organ Donations? A Green Party Politician Launches A Controversial Survey on X

Trump Demands Iran’s “UNCONDITIONAL SURRENDER” As The US Prepares To Go To War With Iran, Triggering A Global Military & Financial Crisis

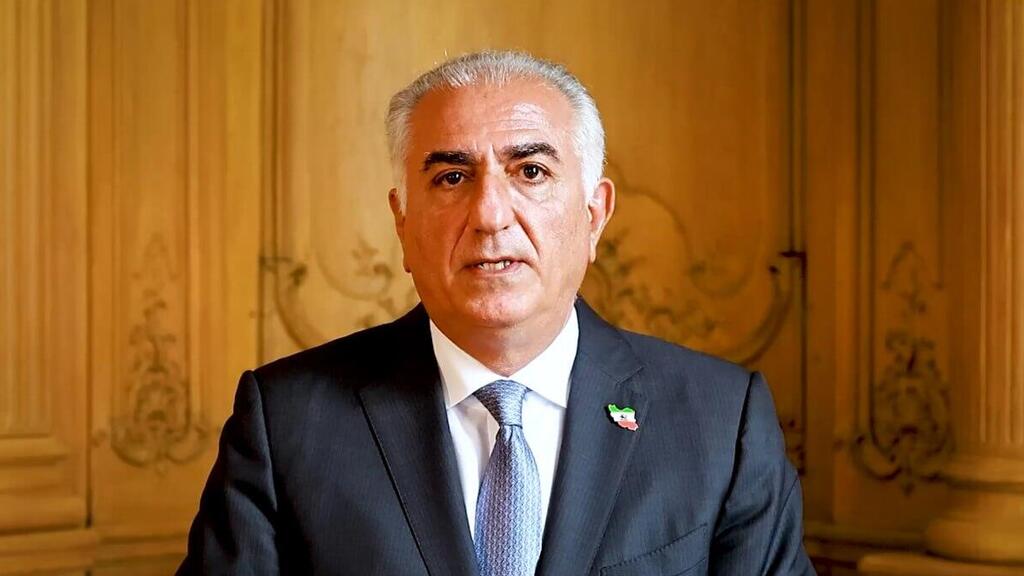

Exiled Crown Prince Of Iran Says the Islamic Republic Has “Come To An End”

The exiled US-backed Iranian monarchy has called for an uprising by the Iranian people amid the country’s ongoing standoff with Israel. In a huge development. Reza Pahlavi, the exiled son of the deposed Shah of […]

The post Exiled Crown Prince Of Iran Says the Islamic Republic Has “Come To An End” appeared first on The People’s Voice.

France Pushes Digital ID Check Laws For Platforms Like Reddit and Bluesky

VIDEO: The US Joining Israel’s War With Iran Will, “Effectively End Trump’s Presidency,” Tucker Carlson Tells Steve Bannon In DIRE Discussion On, “Some Of The Most Perilous Times For The American Republic In Its History”

UK Officials Used Flawed Data to Dismiss Pakistani Grooming Gang Claims