Police Seize 15 Toddlers From Mansion of Couple Suspected of Operating Surrogacy Baby Mill

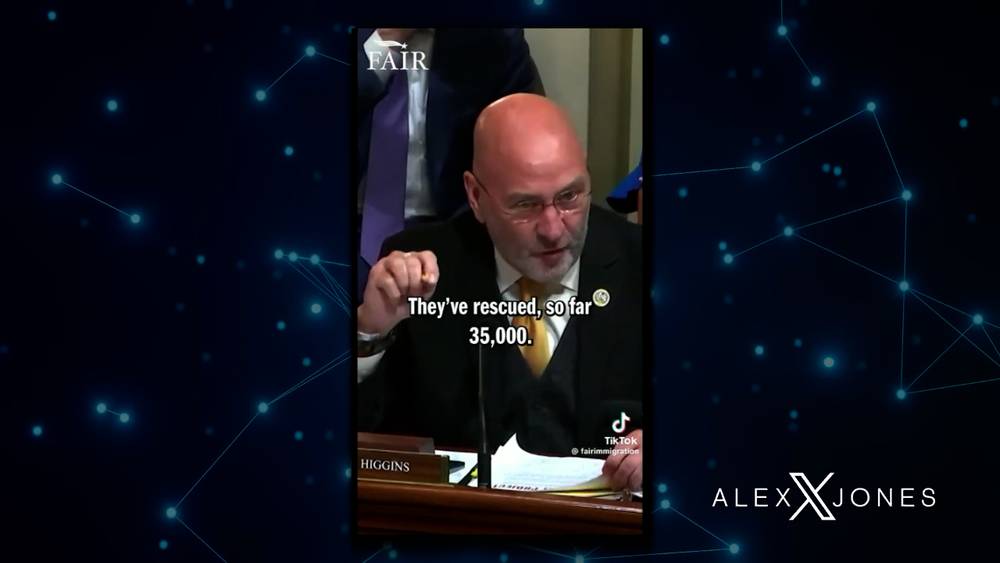

BREAKING VIDEO: Rep. Clay Higgins Reveals 35K Children Have Been Rescued By The Trump Admin After Being Trafficked By Biden’s HHS & NGOs For Sex Work / Slave Labor In The US

Europe Turns Right on Third Worlder Invasion: Member States Rewrite the Rules

NATO Top Commander: Patriot Missiles Must Move From European Allies To Kyiv ‘As Quickly As Possible’

Catholic Blog Removed by Google Causes Censorship Uproar